(4 ratings)

(4 ratings)

Google, a unit of Alphabet Inc, said it would completely boycott promotions for payday advances as these "tricky or unsafe money related items" exploit helpless clients. Google, which joins Facebook Inc in blocking promotions by payday moneylenders, reported its choice a day after the US Treasury proposed that online loan specialists bolster more straightforwardness in their exchanges.

Payday banks, which offer little advances at high financing costs that must be reimbursed in a brief timeframe, have gone under feedback as borrowers regularly neglect to pay the advances or tend to renegotiate them, expanding their obligation.

"Research has demonstrated these credits can bring about excessively expensive installment and high default rates for clients," David Graff, executive of worldwide item arrangement at Google, said on Wednesday on a Google blog. Offers in online loan specialist Enova International Inc fell 6.2 percent on Wednesday while the World Acceptance Corp was down 3 percent.

"It's frustrating that a site made to give clients full access to data is settling on subjective decisions on the promotions clients are permitted to see from lawful organizations," Kirk Chartier, Enova's head showcasing officer, said in an announcement. He encourages included that Enova did not anticipate that noteworthy effect will its business from Google's choice.

The organization will boycott ads for credits where reimbursement is expected inside 60 days of the date of issue. In the United States, the organization will likewise boycott ads for advances with yearly rate rates (APRs) of 36 percent or more.

Government policymakers and controllers have in the past talked about and rejected topping APRs - or yearly financing costs on advances - at 36 percent. Some states, including New Hampshire and Montana, have done as such at local levels, be that as it may, as indicated by the Consumer Federation of America.

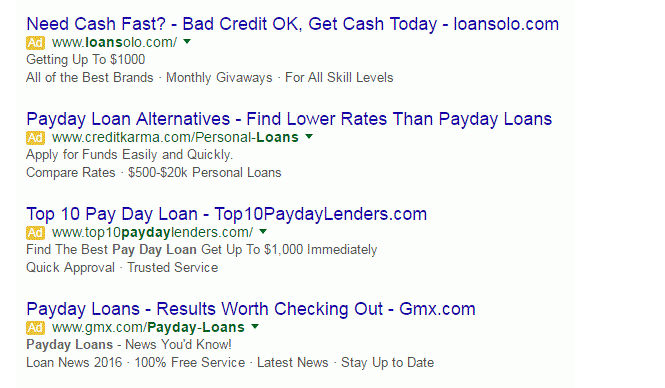

"To make a promoting decide that fails to follow state and government law is irritating, as well as it's unfair, a specific class of individuals who wouldn't generally fit the bill for normal credit now can't get credit ... It's them (Google) choosing who can and can't have data about credit." Lisa McGreevy, CEO of the Online Lenders Alliance, told Reuters. Promotions that show up on the top and right half of a Google list items page will no more show showcasing from the payday loaning industry from July 13.

Must Visit Our Google+ Community Page For Latest And Updated Technology News.