(4 ratings)

(4 ratings)

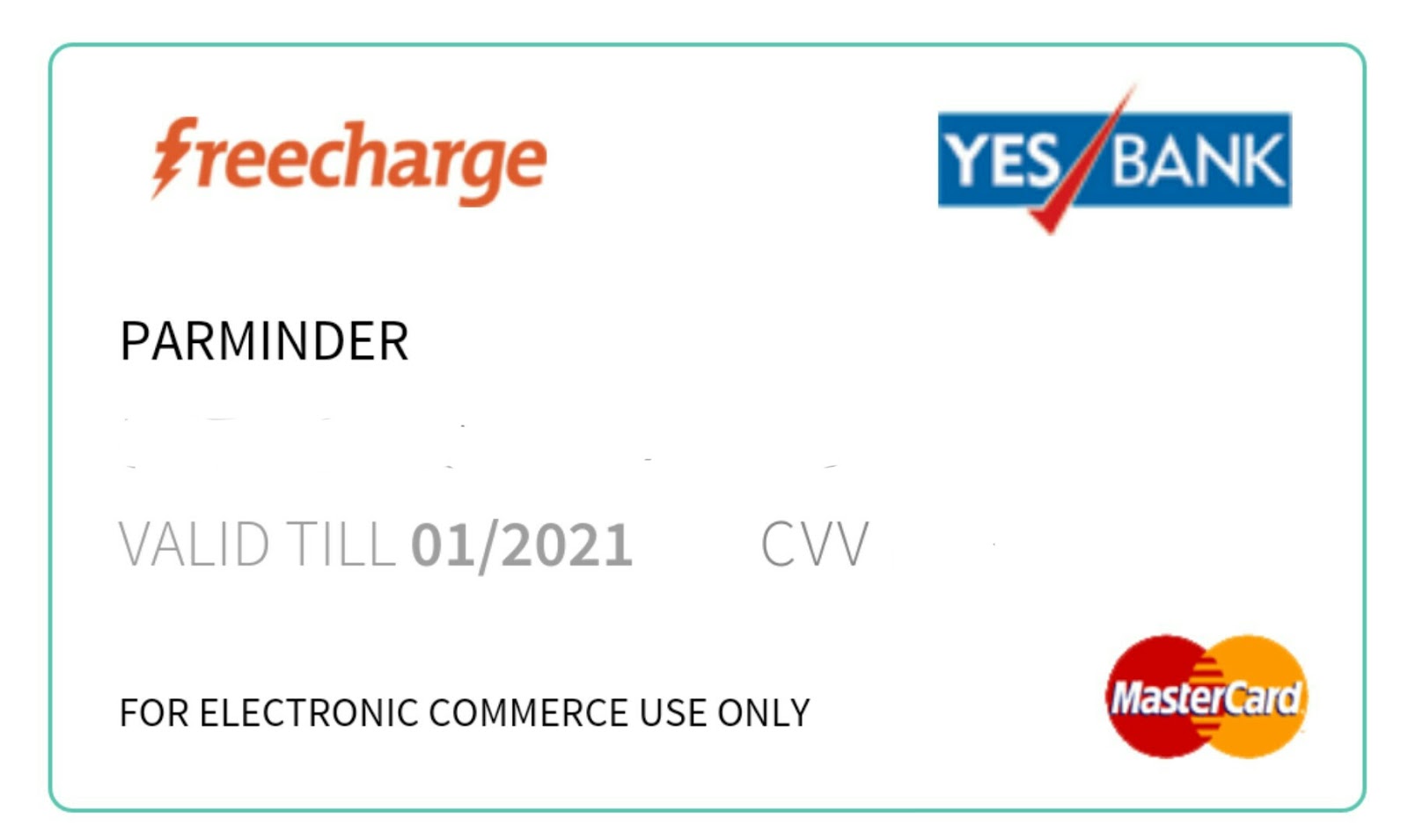

Freecharge, a digital payment gateway, had launched a Virtual Go Card, 10 days ago and now the company has pronounced that Go card has crossed half-million figure in just 10 days. The Freecharge was launched in association with Yes Bank and powered by MasterCard which enables payment on most of the online portal, which accepts MasterCard. Snapdeal, an online shopping portal owns Freecharge.

Freecharge said that the company is focused on creating a new digital transaction portal in India and intended to create an ecosystem for digital payments that competes with the ecosystem of cash. Govind Rajan, the Chief Operating Officer, said, "We timed the drive well, just when a major sale was going on in the e-commerce world. The card solves the last mile problem for applications as well as issuers,". He also said, "our real goal is to become the digital payment operating system of the country. If India has to become Digital India, then you definitely need a Payment OS".

Providing an update on the usage of the FreeCharge Go card, Rajan said that the average transaction amount is much closer to a debit card, which is usually lower than a credit card. "This means that it is opening up a new set of customers who really couldn't really access a card and were reliant on cash-on-delivery," he said. "The real impact of this is that a FreeCharge Go card can be used on portals that are considered competitors to Snapdeal. The philosophy of that is that fundamentally, we're competing with cash, our product needs to be much better than cash," Rajan added.

Its noteworthy that, the FreeCharge Go card cannot be used on international payment gateways and on services like Google Play or the iOS Store. When enquired upon this issue, Rajan said, "Today it is not allowed from a regulatory perspective. Whenever the regulations open up for the wallets to be used across country barriers, that can be done".